What is a personal loan?Personal loan is a type of loan where you borrow money to fulfil a variety of needs and wants. Mostly, in a personal loan, you are free to use the funds any way you wish, like paying for a vacation, debt consolidation, etc. It is mainly availed for financing large purchases.Features of Personal Loan:No need for collateral.Interest rate depends on your Income and credit history, where interest rates can go up to 130% for risky borrowers. Insane, right?Loan tenure is from 3 to 60 months depending on the amount. Minimal Docs enough – ID proof, Address proof, Income proof.Faster Processing Time where loan is processed within minutes.Common reasons for taking out personal loansBuying a GadgetMedical EmergencyEmergency Expenses.VocationWeddingDebt consolidation, where you clear all your high interest rate debt and credit card debts with one single personal loan.Downpayment for house.Vehicle financing.To start a new business.Improve your credit history. 4. When personal loans are beneficial than other types of creditWhen you don’t have any collateral/assets with you.When you need the loan on the same day.When there are many different expenses.When you like to pay fixed EMIs than varying EMIs.When you are thinking of opting for a credit card for money needs, also check the interest with the personal loans as they can go way beyond credit card interest rate if you are a risky borrower.

Category: Uncategorized

Personal Loan Part 3

APR (Annual Percentage Rate) It’s the percentage that shows us the total cost (in %) of borrowing money from that lender. It includes interest rate plus additional fees, charges for the lending of the money. APR is used by borrowers to know how much a loan is costing them, compared to APY (annual percentage yield), which is used by investors to see their return from compounding. APR is useful when comparing different loan products. The nominal interest rate only gives us just the interest rate whereas APR gives us a more clear picture of how much it’s costing to take up the loan. ——————Fixed Interest rate (FIR)Vs Variable Interest Rate (VIR) The rate of interest is fixed for the lifetime of the loan in the fixed interest loans whereas the interest rate varies going up and down during the loan’s tenure after the initial period of 3-5 years. FIR is suitable for people who like the comfort of paying a certain amount every month with fixed monthly income and like to not bother with market conditions whereas Variable rate is suitable for people who think the market conditions will get the interest rates lower at times making the payments lower. In variable interest rate, the first 3-5 years of monthly payments can be lower compared to the fixed rate loans. ——————–How Interest Rates are determinedMany factors influence interest rates. The main factors are creditworthiness of a borrower, their credit history, government monetary policies, inflation rate, repo rate, etc. Creditworthiness and income are two factors mainly determining the interest rates while taking out a loan. Lenders often offer lower interest rates and higher loan amounts to people with great credit scores whereas people who have lower credit scores, typically under 700 may get higher interest rates with lower loan amounts. DTI is another factor in determining the interest rates. When DTI is above 50%, the lender may take more risk and increase the interest rates. ————-Impact of credit score on Interest rates. Credit score is a critical factor because it shows the lender the past history and the credit behaviour of the borrower. Interest rates can go crazy if the lender is not comfortable with lending or if the borrower is just meeting their minimum criteria. Higher credit scores give a positive sign to the lender that the borrower has been diligent with the credit. Negotiation Better Rates: The interest rates can be negotiated if the borrower has a stellar credit score and has a great reputation with the bank. ———How Lenders Use Risk Assessment to Set RatesLenders cater to a variety of borrowers with varying credit scores. So it’s not possible to give the same terms to everyone. For this purpose, the lenders use risk based pricing where the lenders check certain metrics of the borrower before lending and setting the rates. Main factors includeCredit score : Higher the score, lower the interest rate. Repayment History: Careless behavior or late payments or defaulting signals the borrower is a risky one. DTI ratio: Typically below 50% is the limit. Above 50% indicates that the borrower might default.

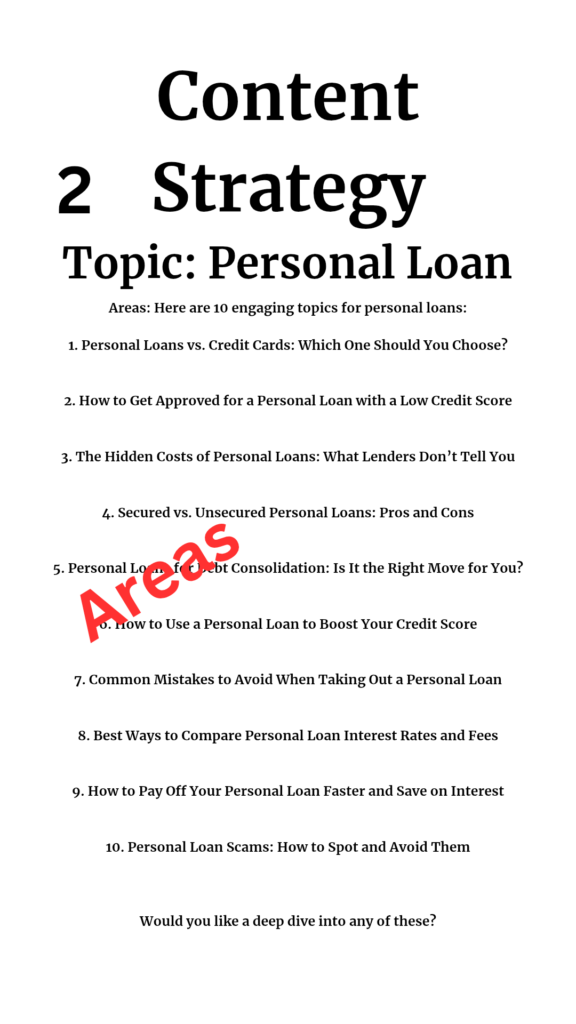

Content Strategy

Best for sales

NOW WHICH PLACE IS BEST FOR SELLING?

WANTS – SOCIAL.

NEEDS & WANTS – GOOGLE.

WHAT I NEED – 20K MONEY – NEEDS.

TSHIRT – NEED. AMAZON, FLIPKART. NEXT SOCIAL.

SOCIAL VS GOOGLE

SLGL.FUN – ANIMATION, STORY VIDEOS, CAROUSEL STORY.

NO – AUDIO, TEXT.

EXPRESSION/HIGH END/EXPLORE/CREATORISH/CREATIVITY- IS SOCIAL MEDIA.

INFORMATION/STRATEGICAL/NEEDS/WANTS IS GOOGLE.

ANOTHER REASON WHY EVERYONE IS ON SOCIAL IS NO TECHINESS INVOLVED.

WHICH ONE IS EASY TO MAKE MONEY ALSO THE COMPETITION. IF THERE IS NO COMPETITION, WHICH ONE IS EASY TO MAKE MONEY. GOOGLE.

FINANCE – STOCKS, LOANS, INSURANCE – EXPLAINER – VIDEO, AUDIO, IMGS, TEXT.

Starting a Post

NATURE/STYLE OF THE POST : STORY, INFORMATIVE, ANYTHING.

whats the word? Idea, subject – for example, topic, niche, sub niche. Eg. Finance –> Stock market or Why Volume is important in Trading.

GOAL OF THE POST : MAKE PEOPLE AWARE OF “THIS”, TEACH THEM, ENTERTAIN THEM.

MODE OF POST: A GUY IN THE SCREEN WITH A VOICEOVER, OR A INSTAGRAM 1O STORY STYLE POST WITH FLATICON GRAPHICS, ETC.

SUBJECT: WHICH SUBJECT YOU’RE GOING TO USE TO CONVEY THE GOAL OF THE POST.

STEP 1 : INFORMATION (KNOW) OR CREATION (LIKE & TALK) or TALK STUFF THAT YOU LIKE OR KNOW. MY LIKE = ROAM AND TALK TO PEOPLE.

STEP 2: GOAL OF THE POST – INFORM, HAVE FUN, GET LIKES (VISUALS & STORY, 2 MIN MIN CONTENT TIME, GET CLICKS (COPYWRITING), ETC.

STEP 3: IDEA/SUBJECT/OUTLINE/HOW. MENTTALLY. FOR EXAMPLE, IM VISUALLY THINKING ABOUT: GETTING UP AND EATING AND GOING SOMEWHERE THEN…

STEP 4: WRITTEN. DETAILS.

STEP 5 : DELIVERY STYLE. CONTENT FORMAT. VISUALS.

ONNU /FORMING/CREATING/ KNOWING, RENDU HOW ARE YOU TELLING IT DIGITALLY.

FORMING (WRITTEN).

RELEVANT DIGITAL CREATION.

SYNCS WITH PLATFORM LOCATION (FORMAT).

TARGET AUDIENCE.

FOR EXAMPLE,

WRITTEN: WHY VOLUME IS IMPORTANT IN TRADING (TRADING) (BEST EXPLAINED IN ANIMATION/VIDEO/BLOG POST) (I WOULD AVOID – AUDIO, INFOGRAPHICS, CAROUSELS)

AUDIENCE & AUDIENCE LOCATION: 20 YEAR OLDS. INDIA. INSTAGRAM, THREADS, YOUTUBE, GOOGLE. Create image with blog content with next in it, do not transform it into a colorful image, slightly ok, not more than 30% because then the content will lose its grip and visuals will get attention.

AUDIENCE DECIDES THE PLATFORM & CONTENTS NATURE DECIDES PLATFORM LOCATION AKA CONTENT FORMAT. THERE CAN BE MULTIPLE FORMAT SUITABLE FOR THE SAME TOPIC. ABSOLUTELY.

BEST FORMAT THAT SYNC WITH THE WRITTEN (CONTENT) AND THE PLATFORM WILL GO TO CREATION.

THEN DIGITAL CREATION TO THAT LOCATION. NOT TO ALL LOCATION.

Introduction

Lets see what financial literacy is for students. Financial literacy means you know how to manage money and not get into trouble with money.

1. Assets and Liabilities.

One simple element of financial literacy is understanding the difference between assets and liabilities. Simply, assets put money in your pocket, for example, rental income and liabilities take money out of your pocket, for example buying an electronic.

Now does that mean assets are always big stuff like home, businesses, etc. Usually yes.

But like I said earlier assets put money in your pocket so if something has to put money in your pocket it should be valuable and the value of the asset should be growing, year on year, more importantly.

This type of financial literacy for students is a must and must be included in their education but unfortunately it’s not there in the syllabus because teachers first are not financially literate.

Now let’s back to assets. Assets necessarily do not mean big stuff, it can be simple stuff like gold, or gold rings. Assets rise in value over a period of time whereas liabilities fall in value over a period of time.

That is enough regarding assets and liabilities for financial literacy for students. Now let’s move onto the next segment in the basics of financial literacy for students.

2. Budgeting

Budgeting is the most simplest tool one can make use of that significantly reduces the stress and thinking one goes through with money.

Simply, budgeting means you allocate beforehand where your money is going to go and how much money is going to go there. Usually this budgeting involves fixed cost and variable cost.

Fixed Cost

Fixed Costs are costs that occur every month the same. For example, the internet pack of airtel is the same every month, although they change once a year or once in two years.

Other examples include monthly groceries, etc, petrol costs for bikes, etc. Fixed costs are usually the same number every month and it is easy to calculate.

Variable Cost

On the other hand, there is variable cost. This cost varies from one value to another each month and it is slightly difficult to allot and track.

Lets see an example.

We all eat snacks. If you allot Rs.1000 for snacks for a month, will you stick to it? Probably not, because you may eat more or less and not exactly Rs. 1000 because of the nature of hunger and cravings and whatnot.

But we can always allocate an approximate number or range like 800-1200. Now that is the basics of budgeting. One month we can slightly go above our budget on certain stuff, but that’s totally ok. Budgeting helps to avoid unnecessary freaking out of going broke anytime, anywhere and puts a system in place that ensures one does not mismanage their money.

3. Savings

Now next, in the segment of financial literacy for students , let’s see about savings. Savings are easy but slightly tricky. Saving simply means you are saving money for future expenditure.

One of the easiest ways to save is to open a savings bank account with a standard and reputed bank and park your savings there.

When the need to use the money occurs, you take it from your savings. One can start with a small portion of the monthly income to savings.

30-40% is a great start to save because later on when you plan to invest, there is enough money for you at the exact time.

4. Debt/Loan

Next on financial literacy for students, let’s talk about debt. Debt simply means money you got from others and you should give or owe to others with interest at specified times, usually monthly.

If you miss the payment, late fees are also applicable. If you pay it before the time, prepayment fees are applicable. Funny, right?

Also one must check the processing fees and interest rates when taking on debt/loan.

Now on financial literacy for students, let’s see the common finance mistakes students make in their student life years.

- No savings.

- Spending all the money for entertainment.

- Not learning about money.

- Not learning about banks.

- They buy high end electronics that will fall in value and they make their parents pay emi monthly, which is a bad mistake.

Common Financial Literacy Practices for Students

- Budget every month. How much you are spending on what. Track your expenses in a notebook or phone or whatever you’re comfortable with.

- Save at least 30% of your pocket money that you get from your parents.

- Start learning about how to make money on the side with simple ideas.

- Use the saved money to fund your ideas.The earlier you start saving a portion of your pocket money, it will become a habit and you will save more for the future when it’s needed.

This is the basis of financial literacy for students.

You can always learn more through books, courses, etc.

I hope you liked this post on financial literacy for students, and I will see you in the next post. Take care.

After reading this post, you’ll be able to:

- Increase Your Productivity 3-5x.

- Have more clarity.

- Have more break time.

- Feel comfortable during work.

- Spend more focused and quality time on your work.

How Can We Increase Our Productivity – 11 Simple Methods

Table of Contents

1. Clarity – Be Clear on Your Goal.

2. Spend More Time On It.

3. Environment Check.

4. Disturbance Check.

5. Dress Check.

6. System Check.

7. Enough Breaks During Tasks.

8. Eat Less Before Session.

9. Get Diverted Totally.

10. Talk with New People.

11. Keep Yourself Cool & Abundant.

Let’s look each one in detail.

In this article, let’s see about Income Tax For Indian Content Creators who are YouTubers, & Content Creators on various social media platforms.

Income Tax For Indian Content CreatorsFirst, let’s clear this bug, that here we are talking about INCOME TAX, and NOT GST.

Let’s say you’re a content creator, maybe a YouTuber, or someone who creates on Instagram, etc.

Let’s say you earned ₹5 lakhs per year on YouTube’s Ad Rev or via AdSense in your Site Or say, you sold a lot of PDFs through link in bio on Instagram or you just consulted people for a price.

Now let’s take that amount ₹5,00, 000.

This is the revenue.Now there are expenses. So we will minus it.

Let’s say our expenses were ₹1 Lakh.

Income = Revenue – Expenses

Income = ₹4 Lakhs.

Now where does this income go?

To your bank account. Which means you earned ₹4 Lakhs.

Let’s worry about the gst later.

For now, you made ₹4 lakhs.

And for income of ₹3-7 Lakhs, the tax rate is 5%.

So you pay ₹20,000 in income tax and go for a coffee with ₹3.8 Lakhs.